What Insurance Covers Hurricane Damage?

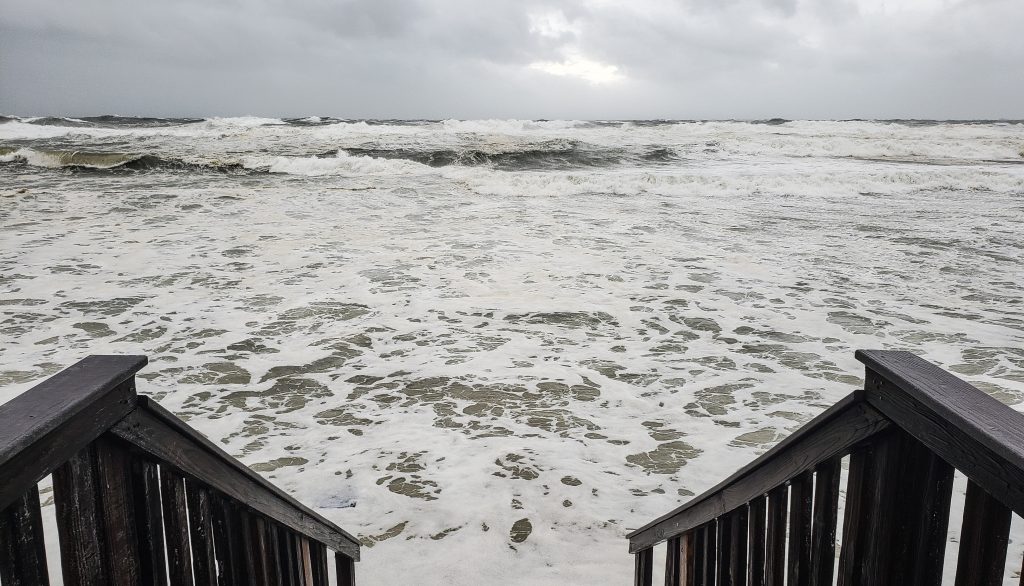

As anyone who has experienced a hurricane can attest, the damage they can cause is often devastating. If you’re not properly insured, you could be left with a huge financial burden. That’s why it’s so important to know what types of insurance cover hurricane damage.

For coverage in a hurricane, you will want to look for something that protects from wind damage, flooding, and storm surge. It’s important to check with your insurance company to see exactly what is covered. Some policies may have exclusions or limits on certain types of damage.

While insurance can’t undo the damage a hurricane can cause, it can help you rebuild and get your life back to normal. That’s why it’s so important to make sure you’re properly protected against this type of disaster.

The experts at Robinson & Stith have the experience and expertise on what insurance coverage you should have in case of hurricane damage. Keep reading to learn more!

What Types of Insurance Cover Hurricane Damage?

It’s always a good idea to check with your specific insurance company to see exactly what is covered under your policy. Some policies may have exclusions or limits on certain types of damage. Some insurance companies will provide actual hurricane coverage, although this is not always the case. If an insurance company does not provide hurricane insurance, you will want both homeowners and flood insurance.

Homeowners Insurance

It’s also important to keep in mind that most homeowner’s insurance policies do not cover hurricane damage. If you live in an area that is prone to hurricanes, you will likely need to purchase a flood insurance policy on top of your homeowners policy.

If you’re not sure whether or not your home is properly insured against hurricane damage, we recommend speaking with your insurance agent. They will be able to assess your risk and make sure you have the coverage you need. However, there are certain damages that your homeowners insurance is likely to cover. Keep in mind that your homeowners insurance likely will not cover the hurricane itself, but the damages that it causes to your home.

One of the main factors that a homeowners policy will cover is any wind damage that is done to your home. For example, if the hurricane rips shingles off your home or blows down trees on your property, this should be covered. You can also elect to include a sewer backup endorsement on your policy so you will have coverage just in case. Sometimes, the heavy rainfall from a hurricane will cause the sewers to back up and overflow, so this is a nice addition to have. You will likely want to also include a flood insurance policy to pair with this.

Check your homeowners insurance policy to see if it has a separate hurricane deductible for damage. North Carolina is one of 19 states that provide potential hurricane deductibles on their homeowners insurance.

Flood Insurance

Oftentimes, flood damage will not be covered by a homeowners policy, even in the event of a hurricane. Because of this, you will need a separate flood insurance policy. Sometimes when you live in an area that is prone to flooding, you actually need to have a flood insurance policy as part of your mortgage terms. Even if you do not live in one of these flood-prone areas, flood insurance is still smart to have.

The cost for your home’s flood insurance will vary depending on several different factors. These include the location of your home and whether or not this is your primary residence, among other things. If you are looking for hurricane protection in the form of flood insurance and homeowners insurance, contact us here at Robinson & Stith in New Bern, North Carolina. We will help you ensure that your home is completely covered in case of an emergency.

What to do if Your Home Sustains Hurricane Damage

If your home sustains hurricane damage, the first thing you should do is contact your insurance company. They will likely send an adjuster to assess the damage and determine how much coverage you are entitled to.

Once the adjuster has looked at the damage, they will provide you with a report. This report will list the repairs that need to be made and how much it will cost. If you have hurricane insurance, your policy should cover these costs.

If you have any questions or concerns about the repair process, we recommend speaking with your insurance agent. They will be able to walk you through every step of the process and make sure you get the coverage you’re entitled to.

Contact Robinson & Stith Today!

No one wants to think about the damage a hurricane can cause. But if you live in an area that is prone to these storms, such as the Crystal Coast, it’s important to be prepared. That means having the right insurance coverage in place.

Hurricane insurance can help you rebuild your home and get your life back to normal after a storm. It’s important to know what types of damage are covered by your policy and to contact your insurance company as soon as possible after the storm.

By taking these steps, you can give yourself the peace of mind that comes with knowing you’re properly protected against this type of disaster. If you live near the New Bern, North Carolina area, contact Robinson & Stith today!