Disability insurance is an essential financial safety net that individuals in New Bern, North Carolina, should consider to protect their income and financial well-being in case they become unable to work due to a disability or illness. Located in a picturesque coastal region, New Bern residents understand the importance of having reliable coverage in place, especially given the unpredictability of life’s challenges.

If you’re looking for disability insurance coverage in New Bern, NC, contact Robinson & Stith today to get a quote!

One of the primary components of disability insurance is income replacement. This coverage provides a portion of your regular income if you become disabled and cannot work. The benefit amount is typically a percentage of your pre-disability earnings, helping you maintain financial stability during your recovery period. This income can be used to cover essential expenses such as mortgage or rent payments, utility bills, groceries, and other living costs, ensuring that you can maintain your standard of living despite the loss of income due to disability.

Disability insurance policies often offer two main categories of coverage: short-term disability and long-term disability. Short-term disability insurance typically provides benefits for a shorter duration, usually up to six months. It is designed to cover temporary disabilities, such as injuries or illnesses that require a relatively brief recovery period. Long-term disability insurance, on the other hand, provides coverage for disabilities that last for an extended period, potentially even until retirement. Having both types of coverage can ensure you’re protected in various disability scenarios, whether short-term or long-term.

Disability insurance policies can be customized to suit your specific needs. Some policies offer optional riders that allow you to tailor your coverage further. For example, a “partial disability” rider might provide benefits if you can work part-time due to your disability, while a “future purchase option” rider enables you to increase your coverage amount as your income grows, without the need for additional medical underwriting. Choosing the right combination of coverage options and riders is crucial to ensuring that your disability insurance meets your unique circumstances and financial goals.

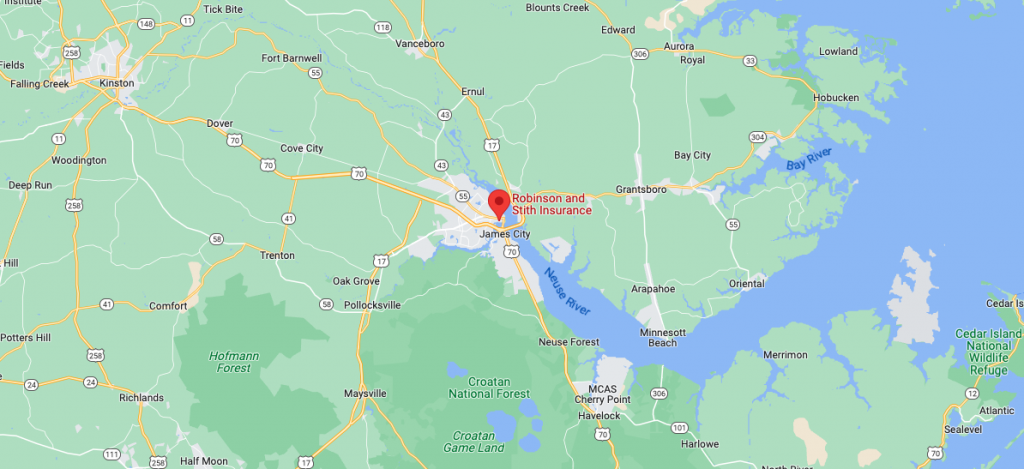

Here at Robinson & Stith Insurance, we are proud to serve customers all across eastern North Carolina! Use the list to find the areas in which we provide our expert Insurance services and customer care.

Because of you—our incredible clients and community—this achievement wouldn’t be possible. Your trust inspires us every day.

Your protection. Our priority.