Long-term care insurance is a crucial consideration for individuals and families in New Bern, North Carolina, as they plan for the future and address the potential need for extended care and assistance in their later years. New Bern’s scenic beauty and serene coastal environment make it an attractive place for retirees, but the cost of long-term care services can be substantial. Long-term care insurance provides financial protection and peace of mind to ensure that individuals can receive the care they need without depleting their savings.

If you’re looking for long-term care insurance coverage in New Bern, NC, contact Robinson & Stith today to get a quote!

The primary purpose of long-term care insurance is to cover the costs associated with various types of care services, including in-home care, assisted living facilities, nursing homes, and adult day care centers. This coverage helps individuals access the appropriate level of care based on their needs and preferences. It can include assistance with activities of daily living (ADLs), such as bathing, dressing, eating, and mobility, as well as instrumental activities of daily living (IADLs), like managing finances and medications. The scope of care services covered can vary, so it’s essential to carefully review policy details to ensure they align with your anticipated needs.

As the cost of long-term care services tends to rise over time, inflation protection is a vital component of long-term care insurance. Policies may offer different inflation protection options, such as a fixed percentage increase in benefits annually or the ability to purchase additional coverage periodically. By including inflation protection in your policy, you ensure that your coverage keeps pace with the increasing costs of long-term care services, providing you with more comprehensive protection in the future.

Long-term care insurance policies offer flexibility in terms of benefit amounts and duration. Individuals can choose policies with different daily or monthly benefit limits, allowing them to tailor coverage to their budget and expected care costs. The duration of coverage is also variable and may range from a few years to a lifetime, depending on the policy. It’s crucial to strike a balance between coverage that adequately meets your needs while remaining affordable.

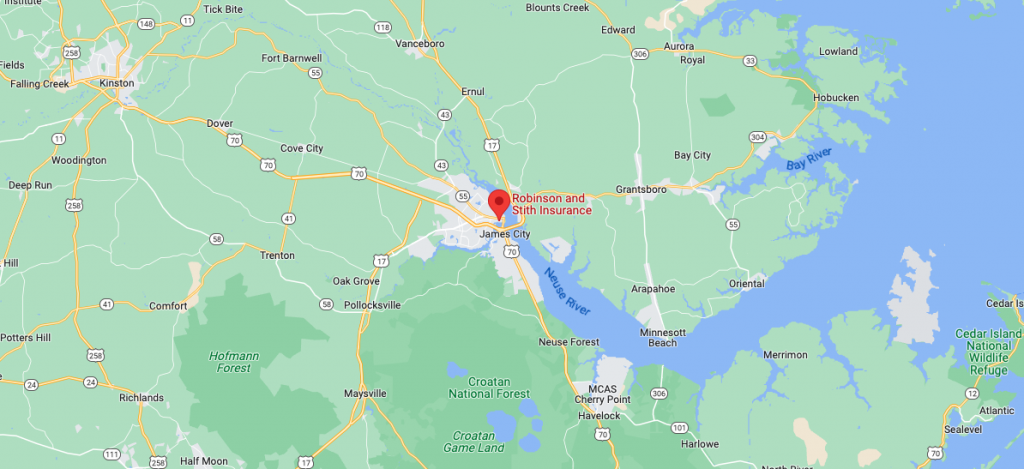

Here at Robinson & Stith Insurance, we are proud to serve customers all across eastern North Carolina! Use the list to find the areas in which we provide our expert Insurance services and customer care.

Because of you—our incredible clients and community—this achievement wouldn’t be possible. Your trust inspires us every day.

Your protection. Our priority.